How do bridging loans work?

- Home

- /

- How do bridging loans work?

- 01 Mar, 2024

Categories Home Loans

How do bridging loans work?

Bridging loans

A bridging loan is a short-term finance to allow you to buy a new property while you’re waiting to sell an existing one. Bridging loans are usually interest-only finance for up to six months if you’re buying an established home, or up to a year if you’re building.

How do bridging loans work?

A bridging loan provides you with the funds you need to buy your new property. It’s a second loan on top of your mortgage on your existing property. When you sell your existing property, your first mortgage is paid out and the total amount you still owe is converted back into a single home loan.

Open bridging loans

You can take out an open bridging loan if you haven’t finalised the sale of your existing property. However, it’s important to understand that this is a high-risk option because if you don’t sell your property, the bridging loan must still be fully repaid on its pre-agreed expiry date.

Closed bridging loans

Closed bridging loans, on the other hand, are a lower-risk option. You can take out a closed bridging loan if you already have a future settlement date in place for the sale of your existing property. Ideally, this settlement date should be unconditional because you’ll be guaranteed to have the funds you need to pay out your existing mortgage.

How to get approved for a bridging home loan

Lenders’ will usually require you to have a significant amount of equity (ownership) in your existing property to be approved for a bridging loan. The amount of equity you have in your current home will depend on its market value and how much you still owe on your mortgage.

For example, if you have a home worth $650,000 and you owe $400,000 on it, your equity is $250,000 (i.e. $650,000 less $400,000).

The advantages of bridging home loans

- They can remove the time pressure for selling your home for six or twelve months.

- They allow you to buy a new property while you’re waiting for your current one to sell.

- They can help you to avoid the need to rent during the time between selling your existing home and buying your new one.

The disadvantages of bridging home loans

- Interest rates on bridging loans are usually higher than they are for standard home loans.

- You might be forced to drop your selling price on your existing home if you’re struggling to sell it before your open bridging loan expiry date.

The bottom line

Ultimately, whether a bridging loan is suitable for you depends on your individual financial circumstances.

How we can help

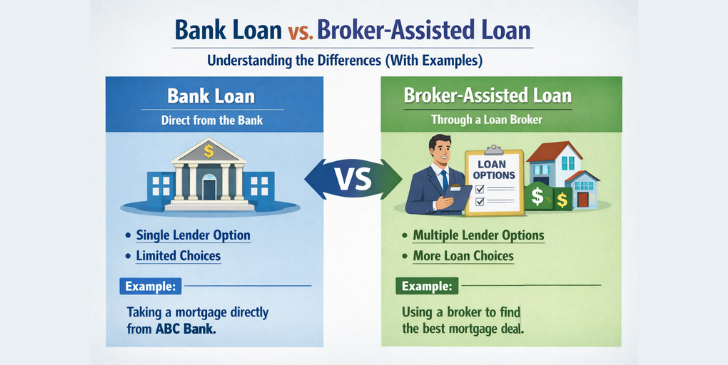

At ARG Finance, our experienced team of home loan brokers can help you to get a Bridging Loan. We’ll take the time to understand your individual circumstances so we can provide you with appropriate advice.

We can also help you with other types of home loans and Business loans, Including Investment Property Loans, Refinancing, Construction Loans and Business Loans.

Contact us today for an obligation-free chat to find out how we can help you!

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.