home loans

- Home

- /

- home loans

Real Estate and Commercial Lending in Melbourne: Trends & Tips

Melbourne is the 2nd largest city and a major economic engine that keeps attracting domestic & international investors across the commercial property sector. Melbourne, so far and for long, has been the most dynamic, influential and growing ecosystem for property in Australia. For this reason, commercial lending plays a very important role in enabling investment, acquisition and development. For developers and investors, access to commercial loans in Melbourne remains a critical factor in determining project feasibility, scale, and long-term returns. Let’s explore more in this blog about the current state of Melbourne’s real estate landscape, key trends for commercial lending,…

- 04 Mar, 2024

Categories Mortgage Broker

7 Steps for Obtaining a Better Mortgage

Mortgages are the base of home ownership in Australia, especially if we are entering the real estate market. Whether it is a first home or an investment property, if we are able to understand common mortgage features and steps then it will help us compare the available options and control our future finances. Upon entering the mortgage process, there will be a number of forms and an assortment of paperwork which can confuse us. This can make the process of obtaining a good mortgage seem complicated because of the number of people and procedures involved. All this can appear overwhelming at times, and…

- 04 Mar, 2024

Categories General

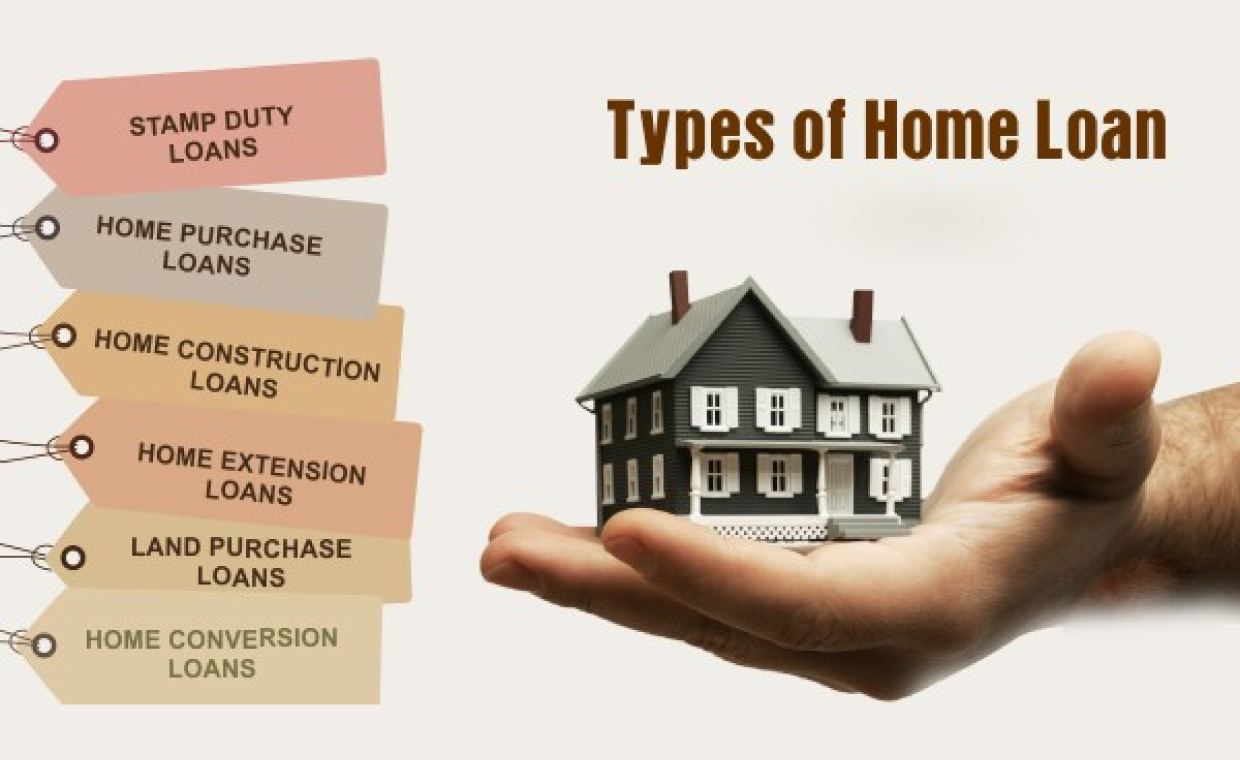

Types Of Home Loans You Were Not Aware Of [Infographic]

The mortgage market in Australia is a mesh of thousands of different types of home loans. It is natural for a first home buyer to get confused while sifting through so many options. While you may not need all of these, it always helps to know your options to make an informed decision. The most basic types of home loans are the fixed and the variable rate loans. Variable rate loan is the most popular type amongst Australians. Your repayment amount keeps changing in a variable rate home loan as your interest rate fluctuates with that of the market. On the other…

- 04 Mar, 2024

Categories General

Seven Causes For Home Loan Denial | ARG Finance

Most home buyers finally find the right property after months of searching. After that begins the quest for the right home loan. Now all you need is a suitable lender who would finance your purchase. But what happens if you apply for a home loan and the bank rejects your application? Real estate has become one of the most popular channels of investment in Australia. However, buying a property is no mean feat and a lack of funds can be one of the main reasons that can hold you back. So, most buyers resort to a home loan. Apart from keeping…

- 04 Mar, 2024

Categories General

About Home Loan Pre-Approvals You Should Know

If you are shopping for a new home, chances are that you are hunting for the perfect home loan too. But it is not necessary that you apply for a loan after you find your dream home. Rather, you have the option to arrange for a loan beforehand. This is where a loan pre-approval comes into the picture. A pre-approved loan helps you arrange for your finances in advance so that you can go forward with a stress-free search. What exactly is a loan pre-approval? A loan pre-approval can be seen as a preliminary approval by a lender to a prospective homebuyer,…

- 04 Mar, 2024

Categories Home Loans

All That You Need to Know Before Refinancing

Do you remember the first instance when you took out your first home loan? It was a tiresome process, spent in researching a number of loan options so that you could secure a mortgage that best suited your needs and pocket. So, now that you have secured it and bought the home of your dreams, it makes a good financial sense to keep reviewing your home loan at least annually. This will ensure that it is still meeting your needs and providing you with the features or interest rate which had attracted you in the first place. Everything changes and with…

- 01 Mar, 2024

Categories General

What To Consider While Buying Property Off The Plan

In simple terms, Buying A Property off the plan means to buy a property that is yet to be constructed. It involves a person entering into a legal contract to purchase a property before it reaches the final stage of its development. Both investors and home buyers go for the an off the plan purchase, but for different reasons. Buying property off the plan may seem like a tricky option to consider. After all, you are just relying on the promise made by the seller that the property will be developed according to a certain plan on paper. You simply have access…

- 29 Feb, 2024

Categories Home Loans

Cashing-In On Home Equity

What is Home Equity? A home equity loan, also known as a line of credit, is a great option for borrowers in Australian. If you are ever in need of some extra cash, whether during an emergency or other purposes, your home equity can be used as a source of low-cost funds to help you achieve those personal goals. Many parts of Australia’s property market took off in 2014 and 2015, which is not a hidden fact. However, the prime question is, “what does this mean for homeowners?” For homeowners, the catch here is that your home equity is actually…

- 13 Aug, 2019

Categories Home Loans

9 Must-Know Home Loan Terms

Whether you are a first time home buyer or have been within this circle before, you must know what a tiring process buying a home is. Moreover, if this process involves a home loan, then you have to deal with bulky paperwork and uncountable legal formalities. Finding purchase-worthy properties and shortlisting one already sounds like a roller coaster ride, and on top of that, your spirit is bogged down with the real estate industry jargon used by lenders and agents. This sends your thoughts spinning, leaving you with a headache at the end of the day. “Buying a home is…

Good reasons to refinance your home loan now

If you’re wondering whether it’s a good time right now to refinance your home loan, you’re not alone. The combined impact of the coronavirus (COVID-19) restrictions on the economy and Reserve Bank interest rate cuts have led to the cheapest home loan interest rates Australia has ever seen. The economic effects of COVID-19 are likely to continue well into the future. All of these factors make it a good time to compare home loan rates that are available in the Australian lending market at the moment. Right now, home loan fixed rates for owner-occupiers in Australia are as low as 2.09% (comparison rate…