General

- Home

- /

- Commercial Loans

- 24 Jun, 2025

Categories Commercial LoansGeneral

Complete Guide to Commercial Loan

Key Takeaways Commercial loans provide funding for large-scale, long-term business and investment projects Common uses include purchasing commercial property, property investment, or business expansion Suitable for both owner-occupiers and commercial property investors Typically secured by the financed asset (e.g., comemrcial property or equipment) Higher loan amounts, often exceeding $500,000, with…

- 17 Feb, 2025

Categories General

5 Tips for First-Time Buyers: Advice from an Experienced Mortgage Broker

Buying your first home is an exciting milestone, but it can be challenging. The process involves multiple steps, from understanding your finances to finding the right property and securing the ideal loan. Many first-time buyers in Australia face similar challenges, including saving for a deposit, understanding the competitive market, and…

- 04 Mar, 2024

Categories General

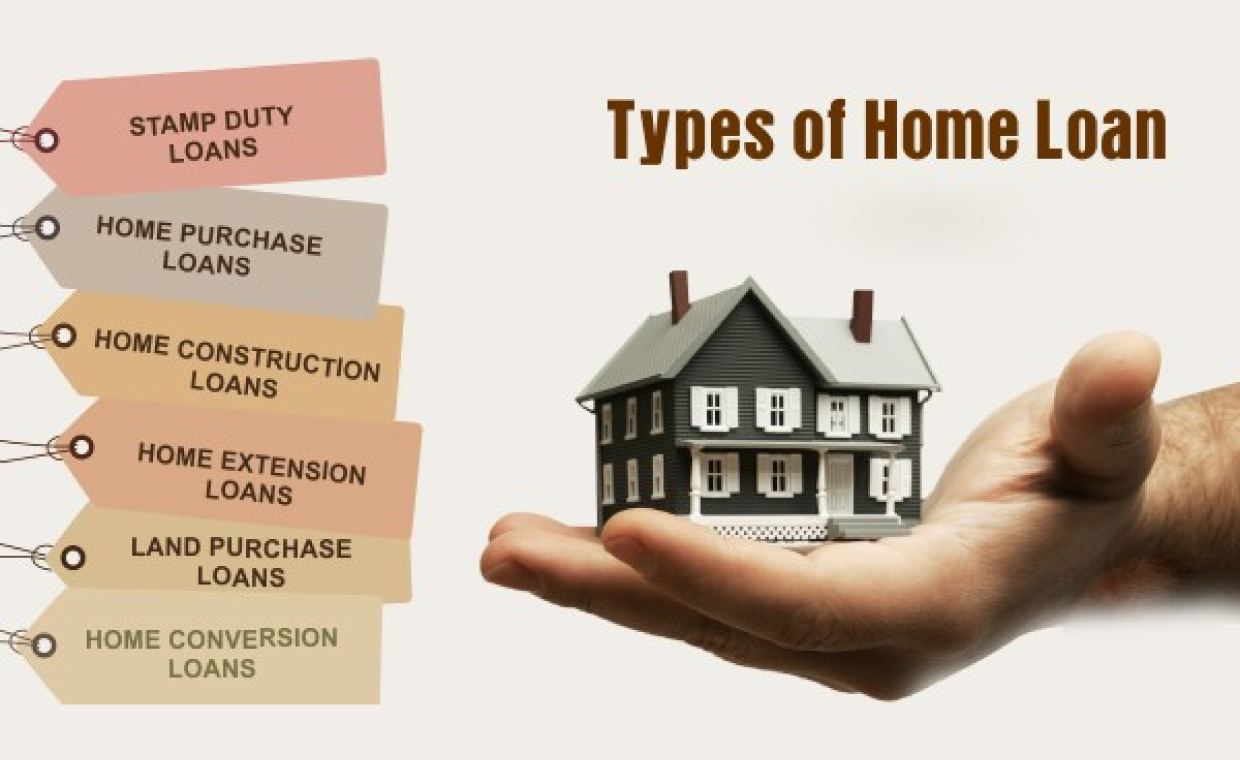

Types Of Home Loans You Were Not Aware Of [Infographic]

The mortgage market in Australia is a mesh of thousands of different types of home loans. It is natural for a first home buyer to get confused while sifting through so many options. While you may not need all of these, it always helps to know your options to make an informed…

- 04 Mar, 2024

Categories General

10 Ways to Get Started Investing in Property

Property, the very word brings a sparkle in the eyes of many prospective couples who dream of having their own home. But these are the end users who are fed up of paying rent and want to use the same money into something constructive that actually bears fruit for them…

- 04 Mar, 2024

Categories General

Seven Causes For Home Loan Denial | ARG Finance

Most home buyers finally find the right property after months of searching. After that begins the quest for the right home loan. Now all you need is a suitable lender who would finance your purchase. But what happens if you apply for a home loan and the bank rejects your application?…

- 04 Mar, 2024

Categories General

About Home Loan Pre-Approvals You Should Know

If you are shopping for a new home, chances are that you are hunting for the perfect home loan too. But it is not necessary that you apply for a loan after you find your dream home. Rather, you have the option to arrange for a loan beforehand. This is where a…

- 01 Mar, 2024

Categories GeneralMortgage Broker

5 Common Strata Title Property Problems and Solutions

Hello folks! If you have recently shifted to a strata community or are planning to do so, you are about to welcome few changes in your life. Being a resident of a strata title property can prove to be beneficial in certain ways. For example, you do not need to…

- 01 Mar, 2024

Categories General

Seven Tips for Purchasing a Home Australia

Going for A Property Purchase Is Never An Easy Task. It is always going to require thorough preparation, that too, in advance. It will also involve huge investment, not just in terms of money but also in terms of time and effort. Before stepping into the real estate market, you need…

- 01 Mar, 2024

Categories GeneralMortgage Broker

7 Renting Nightmares and How to Overcome Them

Buying a property doesn’t always leave you getting to stay in it. Sometimes, we buy it with the intention of investment and renting it out meanwhile. However easy this sounds, all house owners do wonder why their property isn’t attracting a suitable renter or at a price that may help…

- 01 Mar, 2024

Categories General

What To Consider While Buying Property Off The Plan

In simple terms, Buying A Property off the plan means to buy a property that is yet to be constructed. It involves a person entering into a legal contract to purchase a property before it reaches the final stage of its development. Both investors and home buyers go for the an off…