mortgage

- Home

- /

- mortgage

- 04 Mar, 2024

-

Categories Mortgage Broker

7 Steps for Obtaining a Better Mortgage

Mortgages are the base of home ownership in Australia, especially if we are entering the real estate market. Whether it is a first home or an investment property, if we are able to understand common mortgage features and steps then it will help us compare the available options and control our future finances. Upon entering the mortgage process, there will be a number of forms and an assortment of paperwork which can confuse us. This can make the process of obtaining a good mortgage seem complicated because of the number of people and procedures involved. All this can appear overwhelming at times, and…

- 04 Mar, 2024

-

Categories General

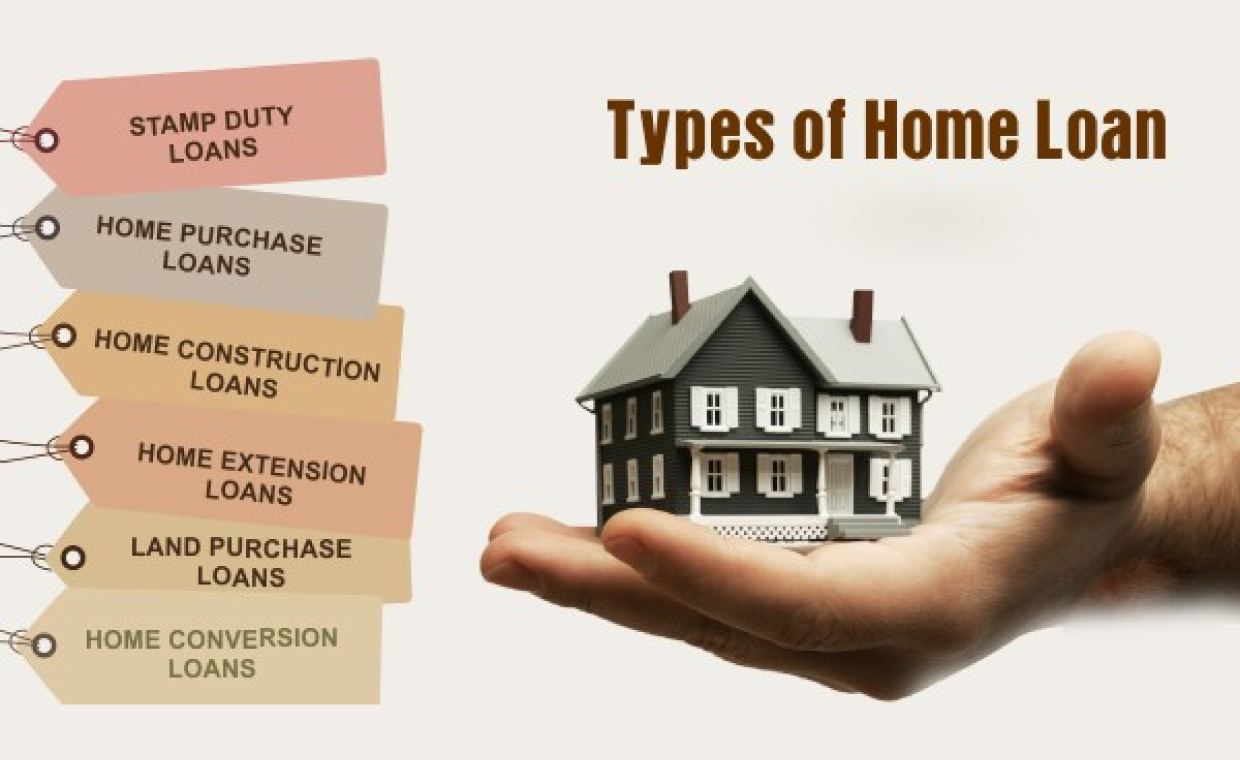

Types Of Home Loans You Were Not Aware Of [Infographic]

The mortgage market in Australia is a mesh of thousands of different types of home loans. It is natural for a first home buyer to get confused while sifting through so many options. While you may not need all of these, it always helps to know your options to make an informed decision. The most basic types of home loans are the fixed and the variable rate loans. Variable rate loan is the most popular type amongst Australians. Your repayment amount keeps changing in a variable rate home loan as your interest rate fluctuates with that of the market. On the other…

- 04 Mar, 2024

-

Categories General

Seven Causes For Home Loan Denial | ARG Finance

Most home buyers finally find the right property after months of searching. After that begins the quest for the right home loan. Now all you need is a suitable lender who would finance your purchase. But what happens if you apply for a home loan and the bank rejects your application? Real estate has become one of the most popular channels of investment in Australia. However, buying a property is no mean feat and a lack of funds can be one of the main reasons that can hold you back. So, most buyers resort to a home loan. Apart from keeping…

- 01 Mar, 2024

-

Categories General

Hidden Costs of Buying A Home | Needs To Remember

So you are finally buying a house and you have all the costs covered. But, wait! Ask yourself again, “Are you really financially prepared to cover all the costs required for buying a property?” Well, isn’t this an eyebrow-raising question? House buying is not only about paying for the price tag that the property comes with. There are a number of hidden costs like the mortgage interest rates, the cost of repairs, cost of the general upkeep of the home, the ongoing council rates, and the list just keeps going on. So, before you go ahead and calculate whether your house…

- 01 Mar, 2024

-

Categories General

7 Questions Every Home Buyer Should Ask

You might be that smart, lucky one who doesn’t need any expert’s help to find the home of his dreams. Yet, for many people, it makes sense to hire one to take care of the tedious tasks and nitty-gritty details of the home buying process. Some of you might find a good real estate agent who will recommend neighborhoods that fit your needs, while also warning you about its possible drawbacks. However, there is also the possibility of coming across shrewd ones, who might take advantage of your inexperience and bore a hole in your pocket. Homes are most people’s…

Good reasons to refinance your home loan now

If you’re wondering whether it’s a good time right now to refinance your home loan, you’re not alone. The combined impact of the coronavirus (COVID-19) restrictions on the economy and Reserve Bank interest rate cuts have led to the cheapest home loan interest rates Australia has ever seen. The economic effects of COVID-19 are likely to continue well into the future. All of these factors make it a good time to compare home loan rates that are available in the Australian lending market at the moment. Right now, home loan fixed rates for owner-occupiers in Australia are as low as 2.09% (comparison rate…

- 29 Apr, 2020

-

Categories Home Loan

Everything you need to know about refinancing your mortgage

Do you want to reduce your mortgage repayments? Are you ready to make your dreams of owning a holiday home a reality? Refinancing your mortgage may be the answer. If you’re like many Australians, your mortgage is likely your biggest financial commitment. While it’s great to know you’re building wealth every time you make a repayment, it’s important to think about how your mortgage impacts your overall wealth. With the current low-rate interest environment, now is a great time to strengthen your finances and take advantage of refinancing. Here’s everything you need to know about refinancing your mortgage. What is Refinancing? Also called…

Latest Posts

-

-

A Must-Have Checklist For Every Home Seller 04 Mar, 2024

-