Negative Gearing And Its Impact

- Home

- /

- Negative Gearing And Its Impact

- 13 Aug, 2019

Categories Asset Finance

Negative Gearing And Its Impact

Australia’s real estate market prices have been on a regular rise and the removal of negative marketing has proven to become a huge hurdle for home buyers, especially the first- timers. Furthermore, the proposal for Negative Gearing, by the Australian opposition party, for cutting generous tax breaks for retail property investors is not making housing any cheaper.

Australia’s pricey property market has been the hot topic of debate lately after Bill Shorten from Australia’s Labor Party’s proposed structural reforms to make housing more affordable.

However, the opinion is that Shorten’s proposal would not have much impact on reducing Australia’s sky-high property prices.

The Negative Gearing reform is well and truly in the sights of both sides of politics. The two main reasons are:

- by reducing tax deductions the government will retain more cash; and

- the investor’s insatiable demand for property will decrease, reducing overall demand for property.

This could lead to more affordable housing for first home buyers. With the Australian Taxation Office funding roughly half of an investor’s losses, the investment class will become less attractive with the reduction in Negative Gearing.

So, what is Negative Gearing?

Negative Gearing is a popular tax provision that property investors use to reduce the amount of tax that they pay on their income.

To explain the term further, if the expenses of owning an investment property, including the interest on mortgage repayments, is more than the rental income on that property, then the loss can be used as an offset against other taxable incomes like someone’s salary.

According to the Australian Tax Office, a rental property is negatively geared if it is acquired with the assistance of borrowed funds and the net rental income, after writing off other expenses, is less than the interest on the borrowings.

There has been a lot of talk in the media about Negative Gearing, but what is it and how can it benefit you?

The Benefits Of Negative Gearing

While making a loss on a property may not sound like a sound investment strategy, the attraction of Negative Gearing is the tax concession. As the owner of an investment property, you can minimise the impact of a loss by offsetting it against your taxable income.

That means that if you own a rental property that costs you $20,000 per year and the rental income is only $15,000, you can use the $5,000 loss to reduce the tax payable on your wage.

This strategy is particularly appealing for high-income earners who want to offset their taxable income.

The Risks of Negative Gearing

While this tax benefit is a major drawcard, you should be mindful of the risks associated with Negative Gearing. Before choosing to negatively gear your property, consider whether you are in a position to maintain the property over the life of the loan.

By negatively gearing a property, you will make a loss that you’ll need to account for. But the question is “What happens when that loss is compounded by other financial burdens from the property?”

There are factors affecting investment properties that are out of your control, such as a shortage of tenants, a downturn in property prices or unexpected interest rate rises. If any of these things happen, will you be able to cope with the additional loss?

Consider these factors when deciding whether Negative Gearing is a realistic strategy for you.

Reducing The Risks Of Negative Gearing

Should you decide that negatively gearing a property will work for you, there are some strategies you can try to reduce the risks.

- Choose a property that will appeal to a variety of tenants. Properties in a good area that are close to amenities are always attractive and are generally vacant for less time.

- Build a buffer into your budget to account for repairs and periods when the property is vacant.

- Take out adequate insurance for the property, so you are covered for those worst-case scenarios.

There have been numerous discussions about abolishing Negative Gearing, considering the rising property prices in Australia, especially Sydney and Melbourne. The issue is that Negative Gearing needs to be considered in the bigger picture.

For instance, if Negative Gearing is no longer available as a tax concession, it is likely that many landlords will raise rent prices, making rental properties less affordable for tenants.

Looking at current circumstances the Government must work towards developing a strategy to improve the supply of affordable rental housing, partnering with the state and territory Governments. This will also assist in easing the pressure on low-income renters.

Is Negative Gearing Right For You?

Negative Gearing should be part of your investment strategy, but not the whole strategy. When you are planning to purchase an investment property, chat with a financial professional about your options and whether Negative Gearing is right for you. Ultimately, the aim of investing is to make a profit and this should always be your main priority.

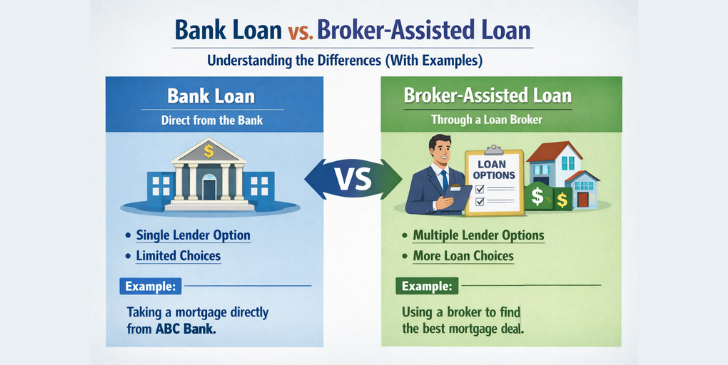

If you need further advice, you can talk to your mortgage broker who will assist you through the entire process and help you create a plan.

When we talk about affordability, there are varied issues that come into play and to only single out Negative Gearing would be short-sightedness.

Negative Gearing has always been a contentious issue. People who already own investment properties can offset their losses against their taxable income. This why people who do not own a home feel that Negative Gearing is more advantageous for those who already own a home rather than for them.

There is no doubt that the availability of Negative Gearing makes investment more attractive. But, because many people utilize it, particularly for residential property, it seems unlikely to be removed.

According to Adrian Pisarski, Chair of housing the advocacy group, National Shelter, “Australia’s current tax arrangements weaken housing affordability. High prices damage productivity, drive key workers to the fringe of our cities, and lock low-income households out of wealth generation, consigning them to deteriorating rental markets and lengthy commutes.”

Why Would Someone Want To Use Negative Gearing?

There are numerous reasons for using negative gearing. Here are four reasons amongst them all:

- The ability to acquire a property in a growth area where the anticipated future growth is expected to exceed the financial cost of negative gearing;

- The ability to acquire a property in an area where you would like to live in the future but don’t have the means of servicing a loan without the receipt of rental income at the present time;

- The ability to diversify an investment portfolio so as to gain advantages of asset or sector diversification; and

- While saving tax should never be a primary goal of any gearing strategy it may, however be an important and integral element which should not be overlooked or ignored.

Over To You

At this point, there is still a lot of talk about whether Negative Gearing will be restricted to new properties only?and if the rate of the tax deduction will be reduced?

No one is sure. For now, it is widely accepted that all existing investment properties or loans will not be affected by any rule changes, with changes taking effect from July 2017.

So, if you are planning to buy property, now could be a good time to get into that investment property.

Happy home buying to you.