Difference between a Bank Loan & Broker-Assisted Loan (With Examples)

- Home

- /

- Difference between a Bank Loan & Broker-Assisted Loan (With Examples)

- 14 Nov, 2025

Categories Mortgage Broker

Difference between a Bank Loan & Broker-Assisted Loan (With Examples)

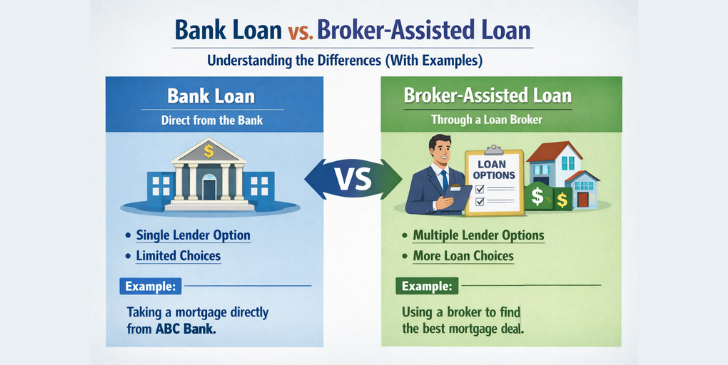

Living in Australia with everything considered is a big deal. Especially if you own a home or a car or an office. The question though is how do Aussies afford all this? Well, through smart Loan and investments. But again, how do Aussies choose between a Bank Loan and a Broker-Assisted Loan? Both options help you with finance but the outcomes can vary on a big level as they both work differently.

Because there are so many lenders, products, and interest rates available, knowing the difference between a Bank Loan and a Broker-Assisted loan will enable you to select the most intelligent and least expensive way.

We will simplify everything for each and every Australian in this blog, and also provide real-life examples and straightforward comparisons. Let’s dive in!

What is a Bank Loan and a Broker-Assisted Loan?

A bank loan is a loan that you take out directly from a traditional or even a major credit union. These banks have a range of products- home loans, car loans, personal loans and business loans, each regulated by their own internal lending criteria. Most common reasons why Australians choose to get bank loans directly from banks are: it is more convenient, they are already loyal to the bank, they can have a bundle of banking products, or they believe that banks are the “safest” option.

A broker-assisted loan is one that is set up by a finance or mortgage broker who is duly licensed in Australia. A broker is not the one to give you the money directly – instead, he acts as your representative, helping you to compare and apply for loans from lenders, which can be banks, non-banks, online lenders, or credit unions. The brokers in Australia are under the regulation of the Australian Securities and Investments Commission while a good number of them also have affiliations with the MFAA or FBAA, which is a guarantee of their high professionalism standards.

Key difference between a Bank Loan & Broker-Assisted Loan

1. Loan Approval criteria

Banks follow very strict policies under which if you are inconsistent with income, are self-employed or own multiple businesses, you may not fit the “Box” and chances are you can get declined.

Broker are experts in dealing with this issue. They are aware of the banks that are most considerate of:

- Self-employed borrowers

- First home buyers

- Low-doc applicants

- Borrowers with minor credit issues

- Australians with casual or contract employment

By doing this, your sanction chances increase significantly.

2. Convenience, Time and Paperwork

- When you apply directly to the Bank, you are the one doing all the follow-ups, research, applications and comparisons.

- While with Broker-Assisted Loans, the broker handles the Paperwork, lender communication, comparisons, settlement coordination, application follow-ups etc. This is an easy option for Australians who tend to be busy almost all the time.

3. Costs & Fees

Several Australian banks impose fees such as:

- Application fee

- Settlement fee

- Annual package fee

On the other hand, the majority of brokers provide their services at no cost to you, as they receive their remuneration from the lender after the settlement of your loan. There could be a situation where a broker might ask for a fee, especially if it is a complicated commercial loan; however, it is always accompanied with a disclosure.

4. Special deals & Interest Rates

Banks generally offer interest rates that are already publicly advertised. Occasionally, you may get benefits or special offers like loyalty discounts if you’re a prevailing customer.

On the other hand, brokers often get access to:

- Limited broker-only discounts

- Cashback offers

- Better fixed or variable rate options

- Special deals from non-bank lenders

As brokers are responsible for submitting a multitude of applications to various lenders, they usually barter for better rates than those obtainable by an individual.

5. Flexibility and Loan options

- Banks generally offer their own products.

- Brokers provide a much broader network of lenders that increase the chance of you finding a better loan product.

6. Support & Personal Guidance

- Banks offer general support only as you’re one of the many thousand customers for them.

- Broker provides assistance with

- tailor-made loan advice

- help from the very beginning till the end of the process

- continuous loan check-ups

- refinance suggestions

- assistance in changing to better deals later

Which one should You Choose

Perhaps a bank loan is the right choice for you if:

- Your financial profile is simple

- You like staying with one bank

- You have an established banking relationship

- You are comfortable comparing options independently

A loan with the help of a broker is perfect for Australians who desire:

- More thorough comparison

- Possibly lower rates

- Quicker approval

- Help through the process

- Flexible options suitable for their circumstances

The majority of Australians nowadays choose brokers because they provide ease, great deals, and personalised support

Examples as Promised

Example 1: Applying for a Home Loan

An Australian aims to buy their first house, so they consider both routes. For home loans, they go to a big bank to see what products are available and get a good summary of the interest rates, fees, and repayment terms that the bank offers.

After that, they talk with a broker who provides them with loan options from different lenders and shows them the comparison of each one. With both pieces of information in hand, the borrower can decide which loan framework, rate type, and features suit their long-term plans the most before they make a final decision.

They end up choosing Bank Loan as they find it safer and the repayment options more flexible.

Example 2: Seeking a Small Business Loan

The small business owner requires capital to scale up their business. First, they take their bank to check if they are eligible based on their business performance and financial history. The bank came up with one lending option that is in line with their internal policies.

The owner pays a visit to a finance broker too who provides the owner with different lender options which are likely to have different criteria for approval or flexibility in repayment. By looking at both the bank’s direct offer and the broker’s wide-ranging comparison, the business owner can list the benefits and drawbacks and decide which loan path is more appropriate for their growth strategy.

The owner chooses Broker-Assisted Loan as he finds the interest rates match his vision and sees more benefits in it.

Final Verdict

Both options work just right if you know your niche for getting Loan first-hand. While Bank loans often come with greater interest rates, they are a “safe” option for many Aussies. On the other hand, Broker-Assisted Loans are hassle-free, you get more choice, better guidance and sharper rates. Choosing the right option depends completely on what you need it for, what’s your situation, ambitions, whether or not you’d like guidance for securing the Loan.

Still unsure whether a bank loan or broker-assisted loan is the right fit for your situation? Get in touch with ARG Finance today and let our experts secure the right finance option for you -tension-free and with complete confidence.