Refinancing Your Home Loan: What Every Melbourne Resident Needs to Know

- Home

- /

- Refinancing Your Home Loan: What Every Melbourne Resident Needs to Know

- 28 Sep, 2023

Categories Home LoanHome Loans

Refinancing Your Home Loan: What Every Melbourne Resident Needs to Know

If you’re a Melbourne homeowner, you might have heard about the benefits of refinancing. Refinancing your home loan can be a powerful financial tool, allowing you to save money and lower your monthly payments or even access extra funds for other investments or expenses. However, before you decide to refinance, there are some important things you need to know.

Check Interest Rates & Compare Lenders

One of the main reasons people consider refinancing is to secure a lower interest rate. Interest rates can fluctuate over time, so if rates have dropped since you initially took out your mortgage, refinancing can save you money over the life of your loan. Keep an eye on decisions made by the Reserve Bank of Australia, as these often influence home loan interest rates across the country.

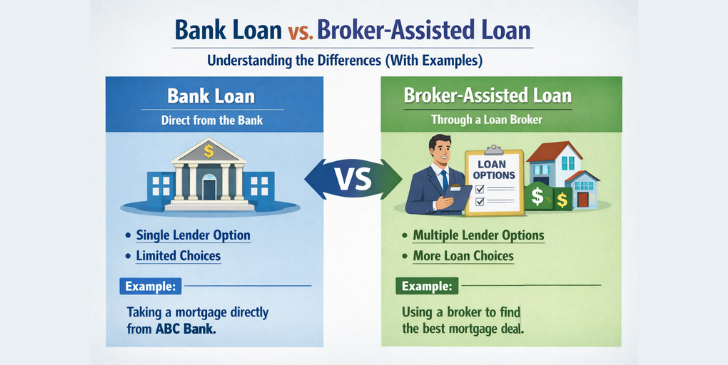

If you decide to refinance, don’t rush into refinancing with your current lender. Take the time to shop around and compare offers from multiple lenders. Melbourne has a competitive housing market, which means there are a lot of options to consider. A mortgage broker can help you find the ideal lender for your unique financial situation and circumstances.

Understand the Fees & Your Credit Score

Refinancing comes with costs such as application fees, valuation fees and potential exit fees from your current loan. It’s crucial to understand these expenses and weigh them against the potential savings. In some cases, the upfront costs may outweigh the long-term benefits, so do your maths before deciding. In addition, it’s important to understand your current credit score. You should regularly check your credit score and take steps to improve it before starting the refinancing process. A better credit score can help you qualify for better loan terms.

Take Your Long-Term Goals into Account

Refinancing your home loan isn’t just about lowering your home loan interest rates to reduce costs. It can also be a way to tap into your home equity, consolidate debt and shorten or lengthen your loan term. Make sure to consider your long-term financial goals when deciding on the terms of a new loan.

Be Prepared & Seek Professional Advice

The application process for refinancing a home loan can be similar to when you initially obtained your home loan. This means you may need to provide financial documents, proof of income and information about your property. Be prepared for paperwork and a credit check as part of the application process.

While there’s plenty of information available online about refinancing a home loan, it’s a good idea to consult with a mortgage broker. If you’re unfamiliar with the nuances and complexities of refinancing, a broker can provide advice that’s tailored to your unique situation and goals.

Learn More Today

Refinancing a home loan can be a smart move for Melbourne residents, but it’s not something to rush into blindly. Take the time to research, check home loan interest rates, compare offers and consider your long-term goals so you can make an informed decision that benefits your financial future. Contact ARG Finance today to learn more and book a consultation with one of our trusted brokers.