Blog

- Home

- /

- Blog

- 17 Feb, 2025

Categories General

5 Tips for First-Time Buyers: Advice from an Experienced Mortgage Broker

Buying your first home is an exciting milestone, but it can be challenging. The process involves multiple steps, from understanding your finances to finding the right property and securing the ideal loan. Many first-time buyers in Australia face similar challenges, including saving for a deposit, understanding the competitive market, and navigating the loan approval process. This blog will help simplify your journey by introducing five essential tips for first-time buyers, backed by insights from industry experts and data from reliable sources. Understand Your Budget and Borrowing Capacity Before you start house hunting, it's essential to understand how much you can…

- 04 Mar, 2024

Categories Mortgage Broker

Proposal to Ease Responsible Australian Lending Restrictions

The federal government is planning on Easing Australia’s lending Restrictions to help the economy recover from the impact of COVID-19. Restrictions on loans and other forms of credit had previously been tightened after both the Banking Royal Commission in 2019 and the National Consumer Credit Protection Act was introduced in 2009. If the government’s proposal to ease restrictions is passed by parliament, it will be easier for both individuals and businesses to get loans or other forms of credit from most lenders in the Australian market. What changes are proposed? There are two major changes proposed 1) A relaxing of Australia’s responsible lending provisions. 2)…

- 04 Mar, 2024

Categories Mortgage Broker

7 Steps for Obtaining a Better Mortgage

Mortgages are the base of home ownership in Australia, especially if we are entering the real estate market. Whether it is a first home or an investment property, if we are able to understand common mortgage features and steps then it will help us compare the available options and control our future finances. Upon entering the mortgage process, there will be a number of forms and an assortment of paperwork which can confuse us. This can make the process of obtaining a good mortgage seem complicated because of the number of people and procedures involved. All this can appear overwhelming at times, and…

- 04 Mar, 2024

Categories Mortgage Broker

A Must-Have Checklist For Every Home Seller

There is every chance that you might make a lot of mistakes and mix-ups when you are in the process of putting your property on the market for sale. After all, it is complicated and involves numerous things that need to be taken care of to avoid common pitfalls. Furthermore, making a mistake with or misunderstanding legal obligations could have a significant impact on our finances and lifestyle. So, we have prepared a checklist for home sellers, which will help them take a breather in between all the hustle and bustle of home buyers and legal works. THE CHECKLIST #1 Choose the right…

- 04 Mar, 2024

Categories General

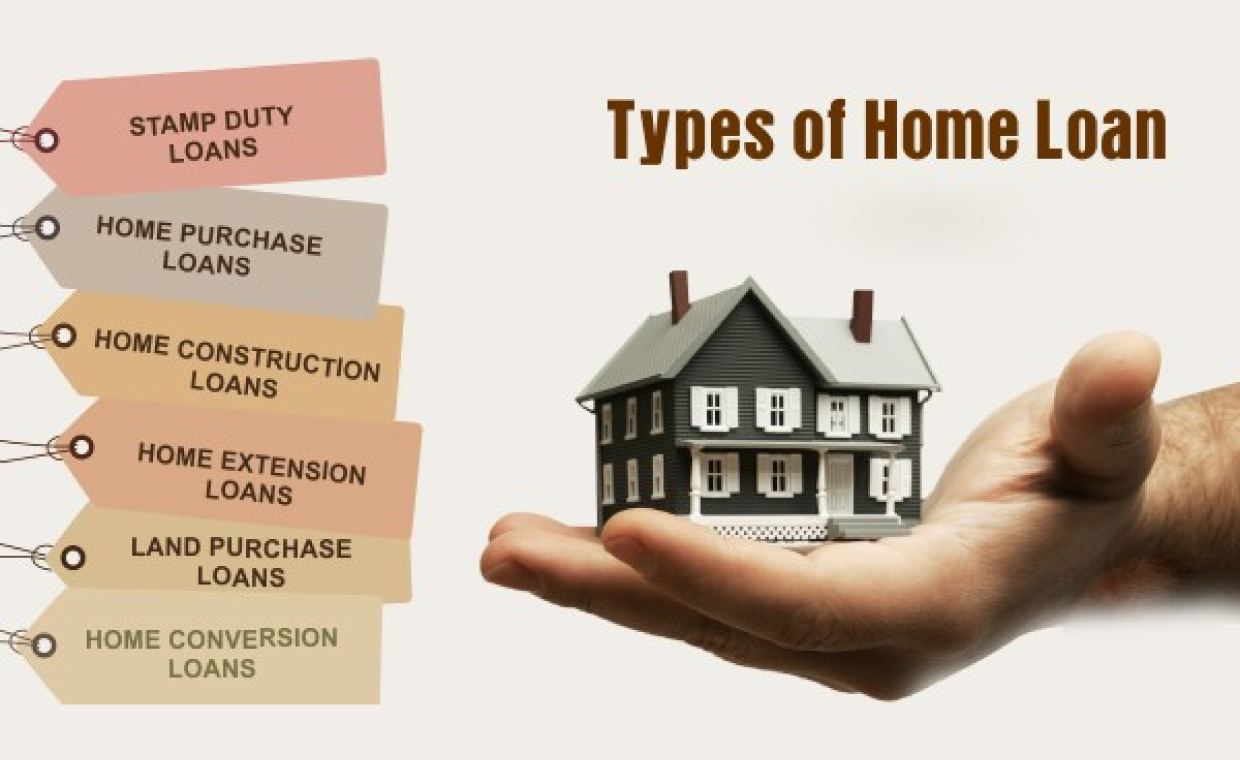

Types Of Home Loans You Were Not Aware Of [Infographic]

The mortgage market in Australia is a mesh of thousands of different types of home loans. It is natural for a first home buyer to get confused while sifting through so many options. While you may not need all of these, it always helps to know your options to make an informed decision. The most basic types of home loans are the fixed and the variable rate loans. Variable rate loan is the most popular type amongst Australians. Your repayment amount keeps changing in a variable rate home loan as your interest rate fluctuates with that of the market. On the other…

- 04 Mar, 2024

Categories General

10 Ways to Get Started Investing in Property

Property, the very word brings a sparkle in the eyes of many prospective couples who dream of having their own home. But these are the end users who are fed up of paying rent and want to use the same money into something constructive that actually bears fruit for them rather than filling the pockets of landlords. But there is another class of buyers who have surplus cash acquired through income from salary or business and want to reap exponential returns. 1.Examine all options before taking the plunge Stories abound from time immemorial of people buying land in the most…

- 04 Mar, 2024

Categories General

Seven Causes For Home Loan Denial | ARG Finance

Most home buyers finally find the right property after months of searching. After that begins the quest for the right home loan. Now all you need is a suitable lender who would finance your purchase. But what happens if you apply for a home loan and the bank rejects your application? Real estate has become one of the most popular channels of investment in Australia. However, buying a property is no mean feat and a lack of funds can be one of the main reasons that can hold you back. So, most buyers resort to a home loan. Apart from keeping…

- 04 Mar, 2024

Categories General

About Home Loan Pre-Approvals You Should Know

If you are shopping for a new home, chances are that you are hunting for the perfect home loan too. But it is not necessary that you apply for a loan after you find your dream home. Rather, you have the option to arrange for a loan beforehand. This is where a loan pre-approval comes into the picture. A pre-approved loan helps you arrange for your finances in advance so that you can go forward with a stress-free search. What exactly is a loan pre-approval? A loan pre-approval can be seen as a preliminary approval by a lender to a prospective homebuyer,…

- 04 Mar, 2024

Categories Home Loans

All That You Need to Know Before Refinancing

Do you remember the first instance when you took out your first home loan? It was a tiresome process, spent in researching a number of loan options so that you could secure a mortgage that best suited your needs and pocket. So, now that you have secured it and bought the home of your dreams, it makes a good financial sense to keep reviewing your home loan at least annually. This will ensure that it is still meeting your needs and providing you with the features or interest rate which had attracted you in the first place. Everything changes and with…

- 04 Mar, 2024

Categories Home Loans

Make Regular Home Exceptional For A Great Market Price

Looking for easy home renovations that can add extraordinary personality to your ordinary house? Your answer is here! Are you thinking of putting your home up for sale? If yes, then remember, first impressions are always the last ones in this case. Furthermore, if you want to maximise your home’s value, then you need to convert it from an ordinary home to something extraordinary, inside out. Home buyers are always on the lookout for something better, convenient, or different. This is all the more reason for you to start with renovations on the property so that you do not miss out…